How to Spot Student Loan Scams.

Things you can do to protect yourself.

“Enroll now and get your student loans forgiven!”

“We can reduce your student loan payments!”

“Don’t wait. Obama student loan forgiveness ends soon!”

If you’re one of the 43 million people with student loan debt, you’ve likely received emails or seen ads online with those claims. As the student loan relief measures that were instituted under the Coronavirus Aid, Relief, and Economic Security (CARES) Act come to an end on January 31, 2022, you’ll likely see them even more frequently. Whether they make false promises about loan forgiveness or charge exorbitant fees to do tasks you could do yourself, student loan scammers prey on borrowers struggling to navigate a complicated and frequently-changing system. The key to avoiding student loan scams is understanding how they work, recognizing the warning signs, and knowing what legitimate resources are available.

College is expensive — averaging $30,030 for a bachelor’s degree from a public university — and most college students use student loans to pay for some or all of their education costs. Of college seniors that graduated in 2019, 62% had student loan debt, according to a report by The Institute for College Access & Success (TICAS). Student loans are installment loans, meaning you’ll repay them with monthly payments over a specific loan term, such as 10 years. They’re an unsecured form of debt and don’t require any collateral. You’ll pay interest on the amount borrowed at either a fixed or variable interest rate, depending on the option you select when you take out the loan.

There are two main types of student loans:

Federal: Issued by the Department of Education, federal student loans tend to have lower interest rates and more repayment options than private loans. The default repayment period is 10 years, and all federal loans have fixed interest rates. For undergraduate students, the interest rate is 3.73% for loans disbursed between July 1, 2021, and June 30, 2022. Any government actions related to student loans — such as the current payment freeze or any future loan forgiveness — typically only apply to federal loans.

Private: Private student loans are issued by banks, credit unions and specialty lenders rather than the government. To qualify for a loan, you need to meet certain income and credit score requirements or have a cosigner on the application. Private loans usually have stricter repayment terms and higher interest rates than federal loans. Undergraduate private loans had rates as high as 14.24% in 2019, according to TICAS.

In February 2021, the Federal Trade Commission announced that it sent more than $1.7 million to student loan borrowers who had lost money due to a company that tricked them into thinking it was affiliated with the Department of Education. Unfortunately, that case is just the latest example; scammers have used deceptive tactics to take more than $95 million in illegal upfront fees over a number of years from student loan borrowers, according to the FTC. So what do these student loan scams look like? They can take several forms:

- They Promise Loan Forgiveness – While there are legitimate student loan forgiveness programs, the eligibility requirements are strict, and only a small percentage of borrowers will qualify for them. However, most people don’t understand how those programs work, making them vulnerable to student loan forgiveness scams. Companies use the possibility of student loans forgiveness to take advantage of people’s desperation and their lack of awareness of issues relating to student loans. Scams talk about ‘Biden loan forgiveness’ or broad-based loan forgiveness from Congress like it’s already happened.

These companies will charge hefty fees to get your loans forgiven. However, there are currently only two federal student loan forgiveness programs, and there are no shortcuts to qualifying for them:

Teacher Loan Forgiveness: Teachers that work in low-income schools for five full and consecutive academic years can qualify for up to $17,500 in loan forgiveness through this program. Only teachers in certain subjects, such as special education or mathematics, will qualify for the full amount of forgiveness.

Public Service Loan Forgiveness (PSLF): Student loan borrowers that work for non-profit organizations or government offices can apply for PSLF. However, you must have worked full-time for a qualifying employer for 10 years while making 120 monthly qualifying payments. PSLF is notoriously difficult to earn. With PSLF, only 2% to 3% of applicants have succeeded in getting their loans forgiven. Although universal federal loan forgiveness is a possibility — albeit an unlikely one, according to experts — information about it should come directly from your loan servicer or the federal government, rather than a third party.

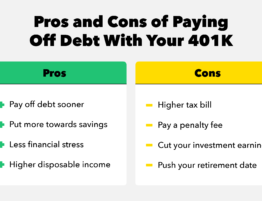

- They Say They Can Lower Your Payments or Consolidate Your Debt – Many companies, sometimes referred to as paperwork student loan companies, will promise to lower your payments or combine your loans into one — for a fee. However, you can do this for free yourself or inexpensively if you hire an experienced expert. Beware of firms that charge thousands of dollars for these kinds of tasks.

- They Ask for Your Federal Student Aid (FSA) ID or Other Personal Information – Rather than trying to take your money upfront, scammers may go after your personal information instead. Some student loan scams will ask you for your FSA ID, claiming to lower your payments or to apply for loan forgiveness for you. But handing over your FSA ID is never a good idea. Your FSA ID is an electronic signature. It’s not just used to log into an account. They also can take out loans in your name and make changes to your account. Aside from your FSA ID, other information scammers may ask you for include your bank account information, credit card information, and social security number. Never hand over any personal information to an unknown source.

Warning Signs of Student Loan Scams – When deciding if a company or service is a scam or not, look for these warning signs:

They demand upfront payment: Debt relief companies, including student loan companies and paperwork companies, cannot charge fees before they perform the services they promise to do. The company is fraudulent if they charge a fee in advance. The government considers them to be credit repair companies, and law enforcement can crack down on the company and shut them down if they charge upfront fees.

They use a high-pressure sales pitch: Companies will try to rush you into handing over your credit card or personal information so you don’t have time to research them. “Stressing the urgency of an offer to instill the fear of missing out is another red flag,” says Tayne.

They ask for your FSA ID: Legitimate loan servicers will never ask for your FSA ID. If a company asks for it, it’s a good indication that it’s a scam.

They use government logos but you can’t confirm their government affiliation: Many companies have gotten into trouble with the FTC for using government logos or making it seem like they’re affiliated with the Department of Education. “There are just a handful of organizations contracted with the Department of Education,” says Kantrowitz. “And none of them are involved in this sort of thing.”

It Sounds Too Good to Be True: When you’re struggling with your loans, hearing about loan forgiveness programs or reduced payments can seem like a godsend. But the old adage applies: if it sounds too good to be true, it likely is. Paying off your student loans is achievable but not necessarily easy, and there aren’t loopholes.

How to Avoid Student Loan Scams – Now that you know some of the most common student loan scams and their red flags, you can view offers and promises more critically. Here are some more tips to avoid falling prey to scams:

- Contact the Federal Student Aid Information Center With Any Questions – You can call the Federal Student Aid Information Center, a government contractor that works on behalf of the Department of Education. It’s a good resource for information on federal student aid and the FAFSA.

- Call the loan servicer with your questions – Your loan servicer is the company that manages your loans after they’ve been disbursed. Your servicer is who you make payments to and contact with questions about your existing debt. Not sure who your servicer is? You can look it up in the National Student Loan Data System or by viewing your credit report at AnnualCreditReport.com.

- Ask Your Financial Aid Administrator for Help – If you aren’t sure if something is a scam, don’t hesitate to reach out to your college’s financial aid administrator. Ask your financial aid administrator to check into things. Even if you graduated a while ago, they’re usually happy to help. Financial aid staff are typically aware of the latest updates to student loan programs, so they may be able to help you.

- Visit StudentAid.Gov to Manage Your Loans – The Federal Student Aid website at studentaid.gov is an official website of the U.S. government. It has a wealth of resources and information about how your loans work, what loan repayment options are available, loan forgiveness requirements, and what to do if you can’t afford your payments. Through Studentaid.gov, you can do the following tasks for free:

Apply for Income-Driven Repayment (IDR) Plans: If your current payments on your federal loans are too high, you can apply for an IDR plan. These plans extend your loan term and cap your payments at a percentage of your discretionary income.

Consolidate Your Loans: If you have multiple federal student loans, you can combine them into one and extend your repayment term to get a lower payment with a Direct Consolidation Loan.

Apply for Loan Forgiveness: If you think you meet the criteria for loan forgiveness, you can apply for PSLF or Teacher Loan Forgiveness online. Or, you can use the PSLF Help Tool to find out if your loans or employer qualify for forgiveness and what forms you need to complete.

Apply for Loan Forbearance or Deferment: If you’re going back to school, have a financial emergency, or are seriously ill, you may qualify for loan forbearance or deferment. If eligible, you can temporarily postpone your payments. You can download the required forms online and submit them to your loan servicer.

What to Do If You’ve Been a Victim of Student Loan Scams – If you’ve already been taken advantage of by a scammer, there are things you can do to potentially recoup your money, file a complaint against the company, and protect yourself against further losses:

Contact your bank or credit card company: If you’ve given a company your credit card number or bank information, contact your card issuer or bank right away. They may be able to reverse the charges or freeze your account to prevent the transaction from going through.

Change your FSA ID: Immediately go onto the FSA website and change your account information and password. If you find that you’ve already been locked out, contact the Federal Student Aid Information Center as soon as possible.

Contact your loan servicer: If you signed a third-party authorization form or power of attorney, contact your loan servicer to have it revoked.

Place a freeze on your credit report: You can place a credit freeze on your credit report, making it impossible for scammers to open new lines of credit in your name. You can set up a credit freeze for free online with the three credit bureaus — Equifax, Experian, and TransUnion.

File a complaint with the FTC and consumer financial protection bureau (CFPB): After you’ve taken the appropriate measures to protect yourself, file a complaint with the FTC and CFPB. You can submit your complaints at ReportFraud.FTC.gov and ConsumerFinance.gov/Complaint. Unfortunately, you may not be able to recoup your losses. However, the FTC has won lawsuits against fraudulent companies and then distributed the settlement to scam victims, so there may be some hope.

How to Spot Student Loan Scams

Click Here to learn more about the law firm.

Click Here to view our published books.