Exempt Income Protection Act (EIPA)

Was your New York bank account frozen?

In New York, certain amounts and type of funds are protect from being frozen in a bank account in reference to the collection of private debts.

In 2008, the New York state legislature found that in some instances, creditors were pursuing funds that were legally exempt from freezing and levying. In order to stop these illegal account seizures the New York Exempt Income Protection Act (EIPA) was enacted. Under EIPA, if a creditor attempts to freeze a bank account belonging to the debtor, the first $2100 is protected. If the debtor receives direct deposit of federally protected funds (listed below), then $2750 is protected. If a creditor has attempted to freeze exempt funds in your bank account, then you would need to submit an Exemption Claim Form to the creditor and the bank in a timely manner (within 20-days).

If your account contains exempt benefit funds that are direct deposited, keep your balance under $2750. Examples of such exempt funds are: Social Security, SSI, Veterans benefits, disability, pensions, child support, spousal maintenance, workers compensation, unemployment insurance, Public Assistance, Railroad Retirement benefits, and Black Lung benefits.

If you are trying to protect your earned income from being frozen in your bank account, keep you balance under $2100. EIPA protects 90% of income earned in the prior 60-days. If these funds were received via direct deposit, then it will be easier to show that the funds are exempt as earned income.

The purpose of the Exempt Income Protection Act (EIPA) is to prevent debt collectors and creditors from restraining protected bank funds for repayment on private debts such as credit cards and some student loans.

Some examples of the types of funds that are exempt from debt collection are:

Social Security

Disability Benefits

Alimony or child support

Any form of public assistance (eg. welfare)

Any income earned while on public assistance

Workers compensation

Supplemental Security Insurance

Most public or private pensions

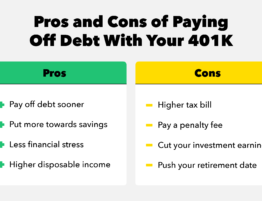

Retirement accounts (401k, IRA)

If you have received notice that your bank account is frozen, then your first step is to completed the Exemption Claim Form and to submit it along with supporting documentation. This must be done within 20-days of the date of the notice of bank restraint. Once the form and documents are submitted, the attorneys and the bank will review the account and should release any funds deemed exempt.

Note that complications can arise in the event of co-mingling exempt and non-exempt funds.

CLICK HERE for information regarding books published by Attorney Ronald Cook.

CLICK HERE to contact the law firm.